Analyze. Connect. Trade.

High-Performance Solutions for Algorithmic Traders

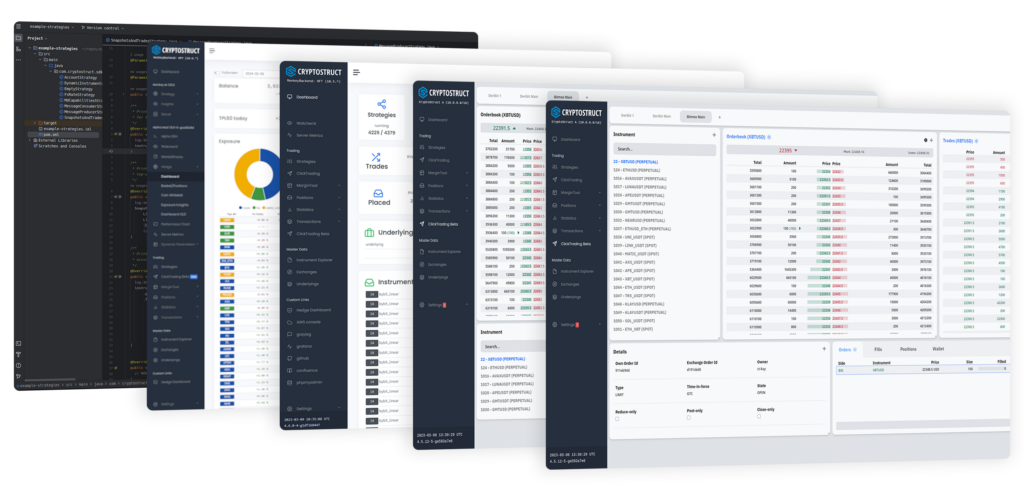

CryptoStruct provides software solutions for algorithmic traders and market makers. Its platform offers normalized low-latency market data, an advanced strategy framework, and a powerful runtime environment, enabling clients to seamlessly execute trading strategies across multiple exchanges.

Free Trial Available!

Experience low-latency, high-frequency trading with unmatched scalability.

Our Solutions

Low-Latency Trading Software

Low-latency, event-driven, highly performant and scalable algorithmic trading runtime with integrated risk management, capable of running thousands of strategies in parallel.

Additional Features

- Sophisticated backtesting capabilities

- Trading analytic tools

- Latency monitoring

- Secure setup (cloud or on-premises) ensures exclusive access to your trading environment

Low-Latency Market Data

- Normalized API across all exchanges; allows for scalability

- Always co-located

- Enhanced feed arbitrage to minimize latency and jitter caused by exchanges

Market Statistics

- Turnover, spreads, OTR, OHLC, VWAP, maker & taker opportunities, latencies and much more

- Available in real-time and historically

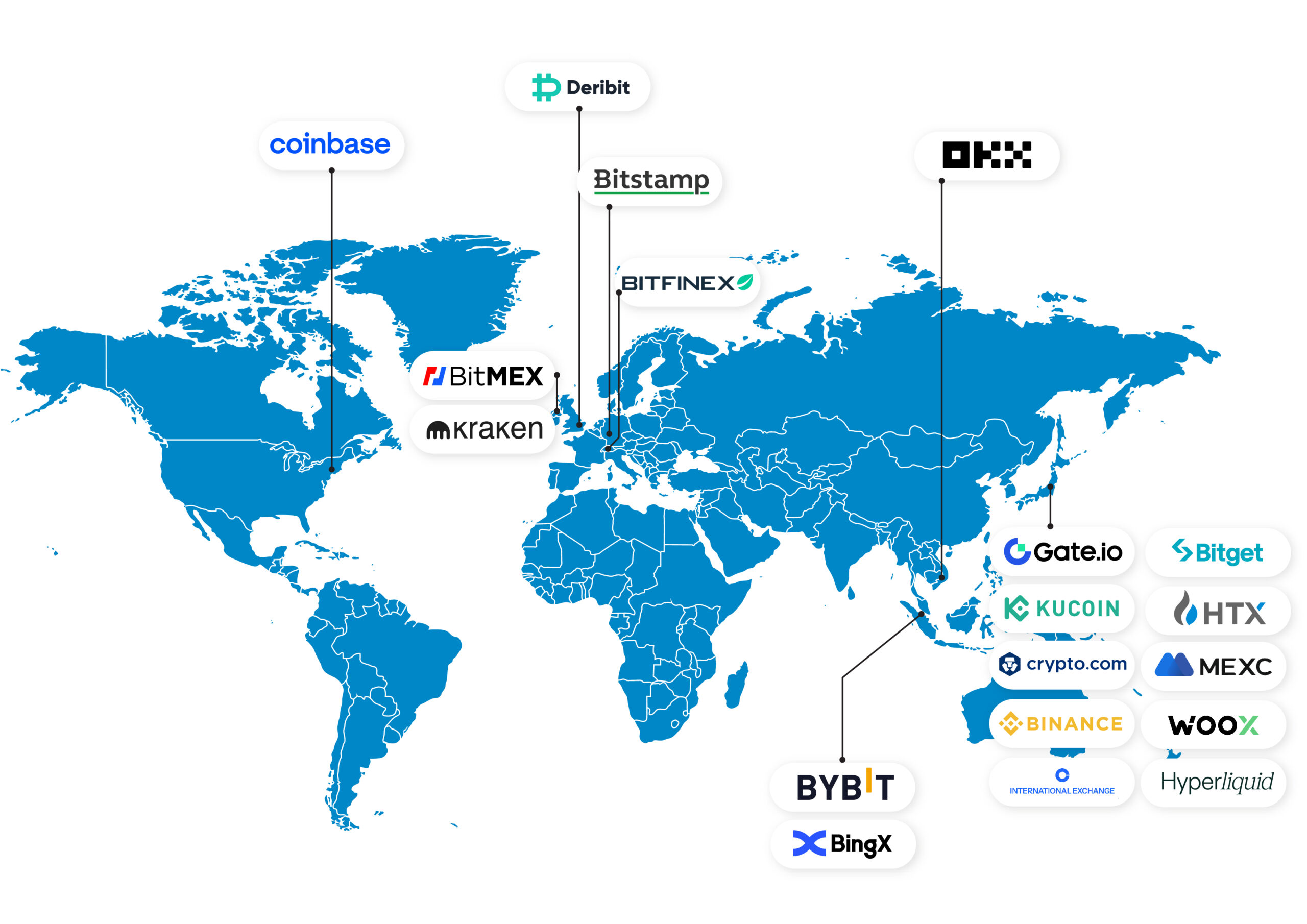

Exchange Coverage

Why CryptoStruct?

high frequency traders

Built for high-frequency-traders and market makers by industry experts

SSW Group

A subsidiary of SSW Group, part of one of Europe's leading proprietary trading firms

Unmatched Scalability

Handle hundreds of millions of orders per day with ultra-low latency

Global Reach

Co-located infrastructure and support for thousands of instruments

Free Trial

Experience the power of CryptoStruct with no risk

Who We Are

- Based in Hamburg, Germany

- A team of industry veterans with decades of expertise in low-latency trading.

- Sister entity of exchange member SSW-Trading; one of Europe’s leading algo trading firms